r&d tax credit calculator 2020

We will show you how. The Inflation Reduction Act of 2022 passed August 12 2022 increases the RD Tax Credit amount from 250000 to 500000.

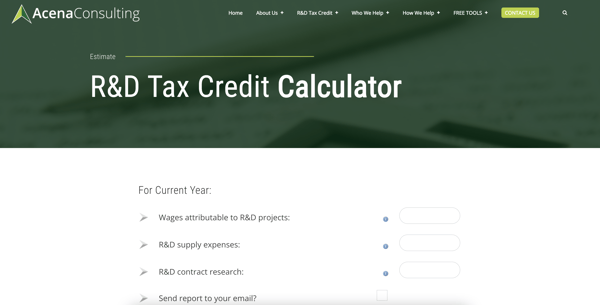

RD Tax Credit Calculator.

. For most companies the credit is worth 7-10 of qualified research expenses. Calculating RD relief for an SME depends on whether your business is profit- or loss-making. The results from our RD Tax Credit Calculator are only estimated.

Find out how much your business could be due using our free RD tax credit calculator. What types of activities qualify for the RD Tax Credit. Since then many states have also passed the RD Tax Credit.

Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. RD Tax Credit Calculation. Want to find out if you are eligible.

If your business is spending money to create a new product or. RD Tax Credit Calculator. We will update our websites.

Companies to increase spending on research and development in the US. With just a few clicks - we can estimate your refund. Or call us now 0333 241 9800.

RD Tax Credit Calculator Nick Tantillo 2020-02-12T2354170000. The current rate for the RDEC is 13. This credit provides much needed cash to hire additional employees increase RD expand facilities and more.

The RD tax credit is a tax incentive in the form of a tax credit for US. This result in this. To calculate your entitlement to the RD tax incentive use our research and development tax incentive calculator.

What is the RD tax credit worth. As such this benefit is available across a wide variety of industries. Need help filing for your RD Tax Credit.

The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years. A tax credit generally reduces. We only charge IF we determine you are entitled to a tax credit.

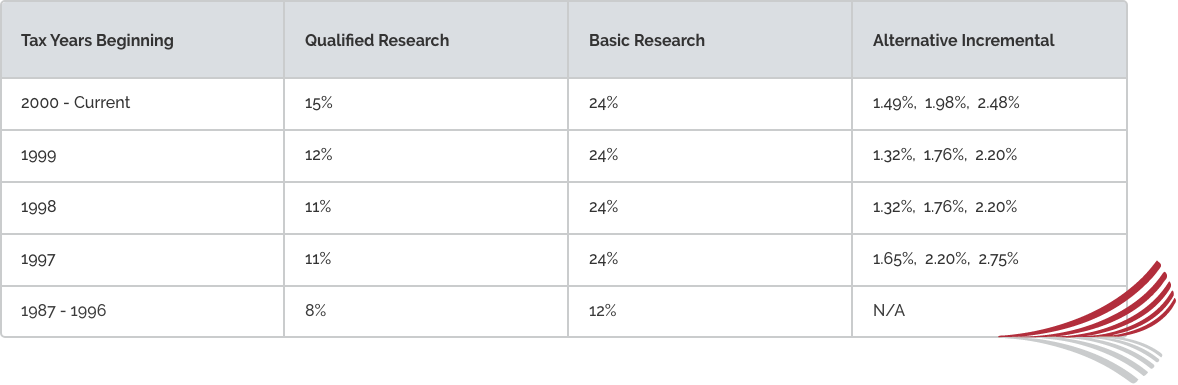

The credit was enacted in 1981 to stimulate innovation and encourage investment in development in the US. How to calculate RD for SMEs. For profit-making businesses RD tax credits reduce your.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. For example if you spent 200000 on RD last. The RDEC is paid as a taxable credit of your RD costs.

If you want to use this. Our experienced tax team will analyze your investment in new. Plus it carries forward.

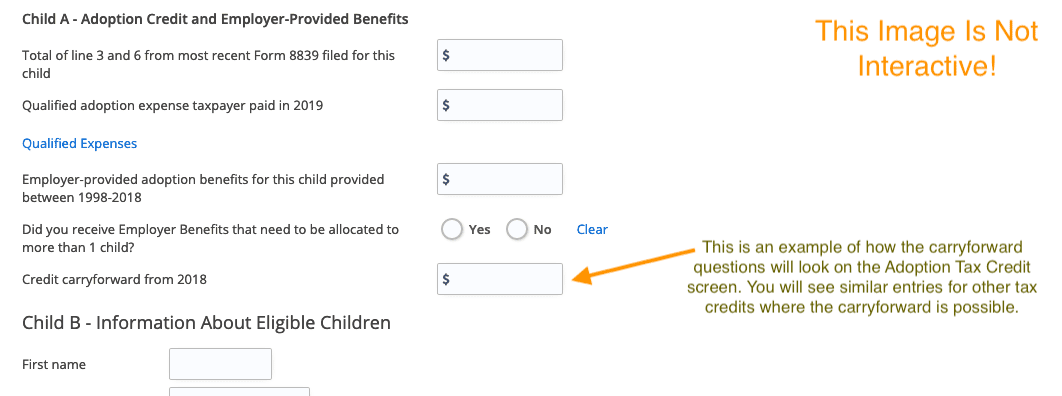

RD Tax Credits Calculator. You can then offset the RDEC against your tax bill or where there is no tax payable you will receive the net amount as cash. Because it is taxable the cash benefit youll receive is 11 after tax.

01633 860 021 hellozesttax. The RD tax credit calculation can be done under the regular research credit method or the alternative simplified credit. Select the relevant year from the drop-down menu.

This is a dollar-for-dollar credit against taxes owed.

Research And Development Tax Credit Archives Review Of Optometric Business

U S Research And Development Tax Credit The Cpa Journal

R D Tax Credits Find Out How Research Development Tax Credits Work

What Build Back Better Means For Families In Every State Third Way

Tips For Software Companies To Claim R D Tax Credits

R D Tax Credit Calculator Get Your Estimate Acena Consulting

Quick And Easy R D Tax Credit Calculator Eide Bailly

What Is The R D Tax Credit Who Qualifies Estimate The Credit

New Irs Guidance Linking Tax Accounting With Financial Accounting Rules

R D Tax Credit Calculation Methods Adp

Federal Tax Credits You May Qualify For On Your Tax Return

Our R D Tax Credit Consultants Ayming Us

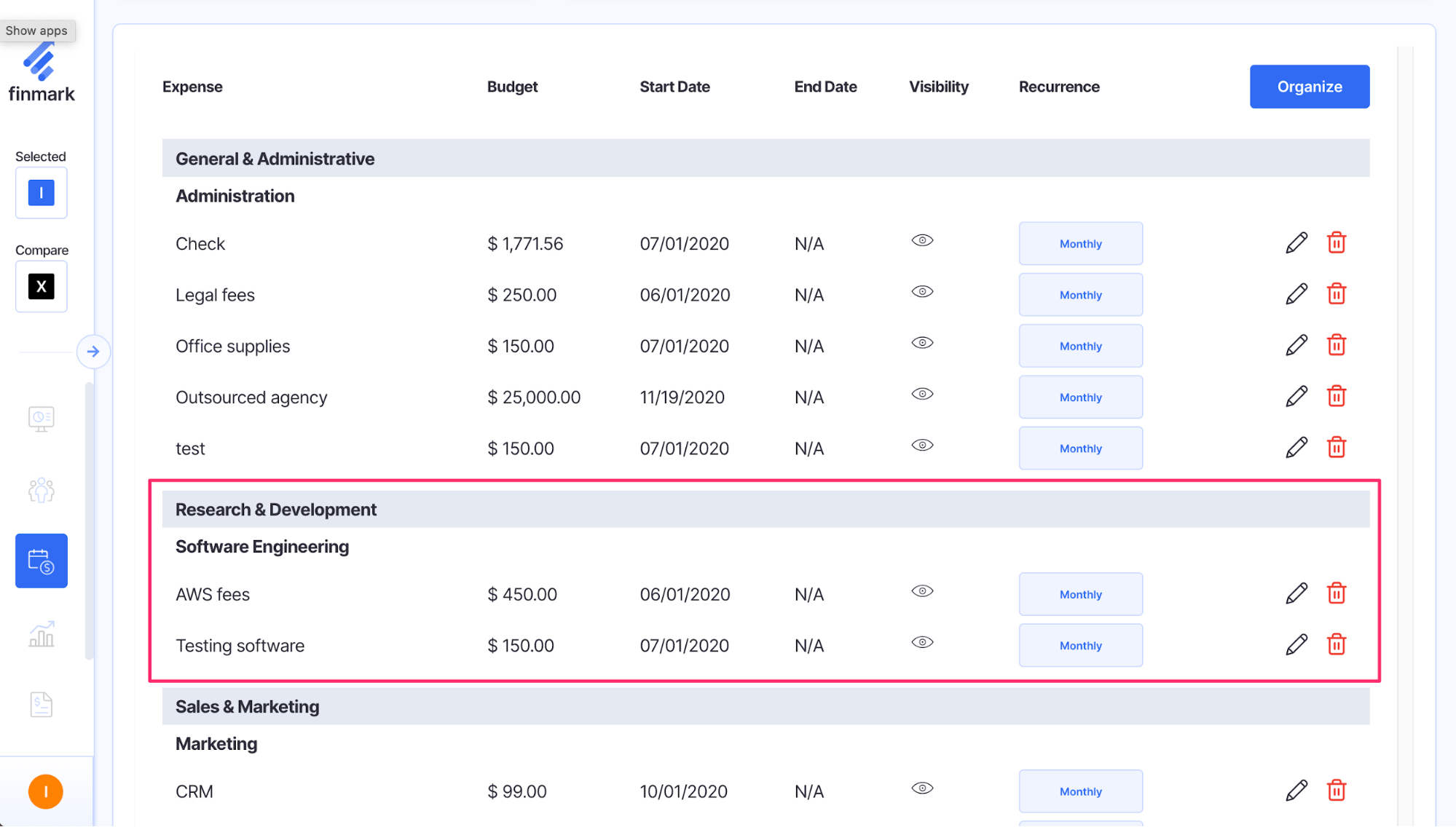

Research And Development Expenses R D Expense List Finmark

California R D Tax Credit Summary Pmba

Tweets With Replies By Direct R D Directrnd Twitter

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation